Residential batteries: the story that doesn’t start or end with Tesla

Tesla is an eye-catching company active in clean energy applications – not only pure electric cars, but also home battery systems, writes Dr. Xiaoxi He, Technology Analyst, IDTechEx. With its launch of Tesla’s Powerwall on April 30, 2015 and every progress update on its Gigafactory’s building, Tesla has continued to fuel interest in home battery systems.

Residential batteries, together with battery applications in commercial, industrial and utilities, are considered to be the next big opportunity in batteries besides electric vehicles. Indeed, this will become a $6bn market by 2026 as predicted by the new IDTechEx Research report ‘Batteries for Residential, Commercial, Industrial and Utility Applications 2016-2026: Technologies, Markets, Players and Opportunities’ (www.IDTechEx.com/res).

On April 30, 2015, Tesla officially launched its residential and commercial/utility-scale energy system products ‘Powerwall’ and ‘Powerpack’ in Los Angeles, with the price well below earlier expectation (the production of 10 kWh Powerwall was stopped due to the relatively low price-performance ratio).

This kind of battery system was not the first approach in the battery systems. As early as 2013, SolarCity already launched an energy storage system called DemandLogic, which was used to reduce businesses’ peak demand, provide backup power during outages and potentially save energy costs. This system also used Tesla battery technology – the same lithium-ion battery packs used in Tesla cars. However, the price of DemandLogic battery system at that time was expensive and was mainly for medium-scale applications.

Tesla always wanted to launch a residential battery storage system that can be accepted by household. The launch of Powerwall could incorporate SolarCity’s plan in residential energy storage. The merge between Tesla and SolarCity further proved it.

In a typical fashion Tesla managed to attract tremendous attention, yet Tesla Energy is neither the first nor the best product of its kind. In fact, in many ways, Tesla is a follower. For example, the German startup Sonnen started to sell residential battery as early as 2011, whilst in the same year in Japan, Sony and Sharp launched their products after the Tohoku earthquake with focused attention on the critical importance of back-up residential energy storage in emergency situations.

Today the residential battery sector is not only being chased by battery makers. Instead, a cross-industry business is taking shape as evidenced by the large number of recent acquisitions, joint-venture and investment. Battery business for consumer electronics has gradually reached a plateau and automotive companies are moving into residential/grid battery areas to de-risk their investment and further reduce battery costs with the help of economies of scale.

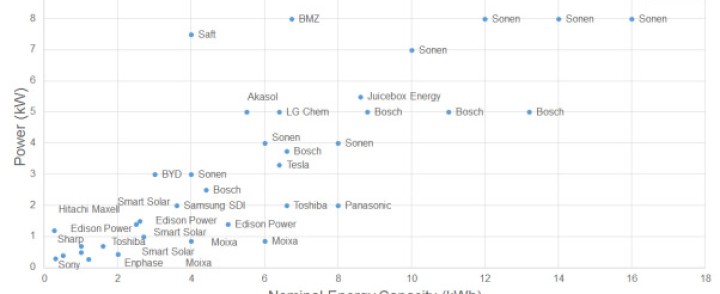

The market is therefore fragmented with companies in various areas jumping in such as solar cells integrators, automotive players, cell makers, battery manufacturers, chemical suppliers, trading companies, power utilities, etc. It is obvious residential batteries can generate both economic values that can be monetized and values that are not directly monetized in households and electricity networks. An important consideration is whether they can demonstrate positive economic return based on current price range and value streams, which is a significant factor when predicting the future deployment. Technology is not the major driver, as analyzed in this report. A large number of key questions are answered in the report.

IDTechEx provides independent research, business intelligence and advice to companies across the value chain based on our core research activities and methodologies providing data sought by business leaders, strategists and emerging technology scouts to aid their business decisions.

- Comparison of current and future residential battery products in the market. Source: IDTechEx Research report ‘Batteries for Residential, Commercial, Industrial and Utility Applications 2016-2026’